estate trust tax return due date

Distributable Net Income Tax Rules For Bypass Trusts

/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Welcome To Black Ink Tax Accounting Services We Hope To Provide You With Timely And Valuabl Accounting Services Tax Preparation Services Offer In Compromise

Printable 2020 W9 Form Free Irs Forms Fillable Forms Tax Forms

Is An Anomaly In Form 8960 Resulting In An Unintended Tax On Tax Exempt Income

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Irs Form 1041 Filing Guide Us Income Tax Return For Estates Trusts

The Basics Of Fiduciary Income Taxation The American College Of Trust And Estate Counsel

Irs Issues Proposed Regulations On Trust And Estate Deductions

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Do Trust Beneficiaries Have To Pay A Tax Filing Taxes Trust Tax Forms

/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

:max_bytes(150000):strip_icc()/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

Estate Planning Checklist Estate Planning Checklist Funeral Planning Checklist Funeral Planning

Is An Anomaly In Form 8960 Resulting In An Unintended Tax On Tax Exempt Income

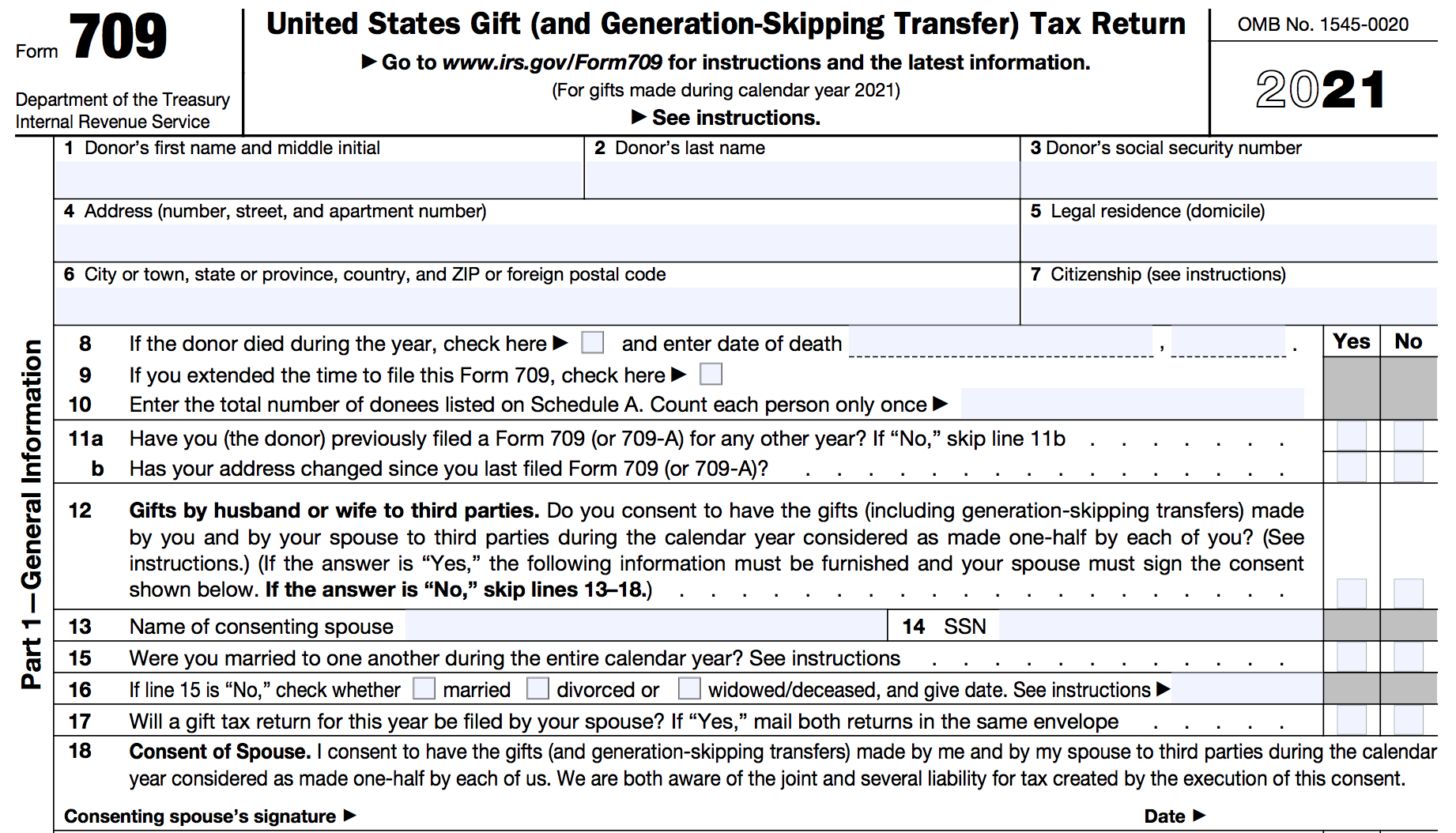

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset